Press Releases

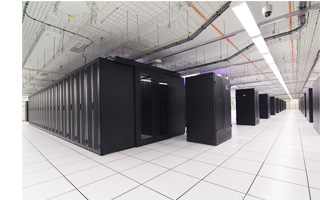

GCC adopts Data Center to save on capital costs

Data Center services in the GCC have risen to the forefront of a general trend towards outsourcing and the need to control business costs. Organisations looking to cut down on capital expenditures involved in setting up information technology operations are increasingly turning to the expertise and infrastructure services of Data Center service providers, thereby boosting market revenues.

“Yes, this is in line with worldwide trends. As business grows rapidly, companies run out of capacity at their initial home-grown Data Centers, their IT systems become business critical, staffing needs magnify and costs rise significantly,” said Dilip Rahulan, executive chairman of Dubai-headquartered Pacific Controls.

“For these reasons, CIOs [chief information officers] and their teams are choosing to relocate and expand in purpose-built, secure and scalable service-provider Data Centers. As part of this move, companies are also looking to move IT to the cloud. A recent Foresights survey showed that 50 per cent of enterprises in North America and Europe are budgeting for cloud services in 2013. With these initiatives, CIOs and their teams get a chance to step back and think about IT strategy and innovation for the future needs of their businesses.”

“Our Data Center campus, the largest in the Middle East, has been in service for more than a year now. We provide colocation and cloud services to multiple customers hosting both production and disaster-recovery systems. Customer segments include airlines, banking and finance, federal and regional government, government-owned establishments and private enterprises,” Rahulan said.

“The business is well-established and mature. As for our newly-launched cloud services, we expect swift ramp-up as IT decision-makers understand the unstoppable momentum of cloud services and the benefits they provide – zero Capex, affordable monthly charges, systems ready for service in days or sometimes even hours, and scalability, among others. This is exactly how cloud has taken off worldwide, and it will happen in the UAE as well.”

Endorsing the same view, a new analysis from Frost & Sullivan, entitled “Data Center Market in GCC”, finds that the market earned revenues of more than $231.7 million in 2012 and estimates this to reach $706.3 million by 2018. The markets in Saudi Arabia and Qatar are expected to grow the fastest owing to their rapid economic development.

“The need for enterprises to easily scale their operations up or down and access the latest technologies without huge capital outlays add to the demand for managed services such as Data Centers in the region. The lack of in-house capabilities to keep up with constantly evolving technologies has further compelled businesses to outsource their IT requirements to Data Center service providers,” said Frost & Sullivan Information and Communication Technologies senior research analyst Jonas Zelba.

Government support for infrastructure expansion, along with e-initiatives which drive digitalisation and virtualisation, have fuelled the growth of the Data Center market in the GCC countries.

However, these opportunities have been curbed by the limited availability of bandwidth in certain areas. The irregular nature of broadband connectivity across different Gulf countries, where only major cities benefit from the fast fibre cable network, affects business development, and, in turn, market growth.

Moreover, security concerns and the lack of trust in the ability of third parties to manage internal IT systems prevent several enterprises and governments from adopting Data Center hosting services. This mindset is particularly prevalent in conservative end-user verticals such as financial services, where security is critical to business operations. Therefore, Data Center providers in the GCC need to invest in raising awareness, especially on the benefits of on-premise models that offer clients visibility and control over IT infrastructure. Building trust among customers gradually by delivering quality services for non-core operations such as router and network management will improve sale volumes in the long run.

“As cloud computing and virtualisation become critical differentiators, Data Center vendors will look to acquire specialised cloud computing companies to give them an edge over competitors,” noted Zelba. “Future Data Centers in GCC, built at low-cost locations with emphasis on green best practices, will also be highly-virtualised and carrier-neutral.”

Khaleej Times - August 16, 2013

Dubai, United Arab Emirates